Steve Brant's Monthly Property Primer

Premier Knowledge. Informed Choices.

December 2025 Edition:

🎅🎄"Merry Christmas & Happy New Year!"🎄🎅

Buckle Up — It’s Been a Wild Ride!

Well folks, it’s been quite a summer and fall.

The market was unpredictable, uncompromising, and full of surprises. The old adage that “the first offer is the best offer” didn’t always hold true — but one rule still did: sellers who positioned strategically were most likely to get their strongest offers within the first 21 days.

In one high-end pocket of San Diego, a fully remodeled home that would’ve commanded over $2 million in 2022 struggled to attract offers above $1.4 million. Meanwhile, a Florida property purchased for $3 million in 2022 now tops out around $2.5 million.

Even though average home prices have technically climbed in both markets, the economics of individual properties have told a different story — especially in the luxury tier. Sellers who adapt quickly, price intelligently, and market creatively are the ones still winning big.

And speaking of winning big… there’s one sale that turned heads this month — a Chula Vista wild ride that proves strategy still trumps everything. (Scroll down for the full story.)

Property Spotlight – Sombria Rd. Showcase

Experience our latest success story — a perfect example of how modern design, cinematic marketing, and timing can transform a sale.

In a market where homes were sitting for months, this Lakeside property sold in just two weeks — and for $55,000 over asking. How? By combining presentation, precision pricing, and the power of OFFER1 technology. This is the story of 9212 Sombria Rd.

December 2025 Market Pulse

Powered by Steve Brant Luxury Real Estate

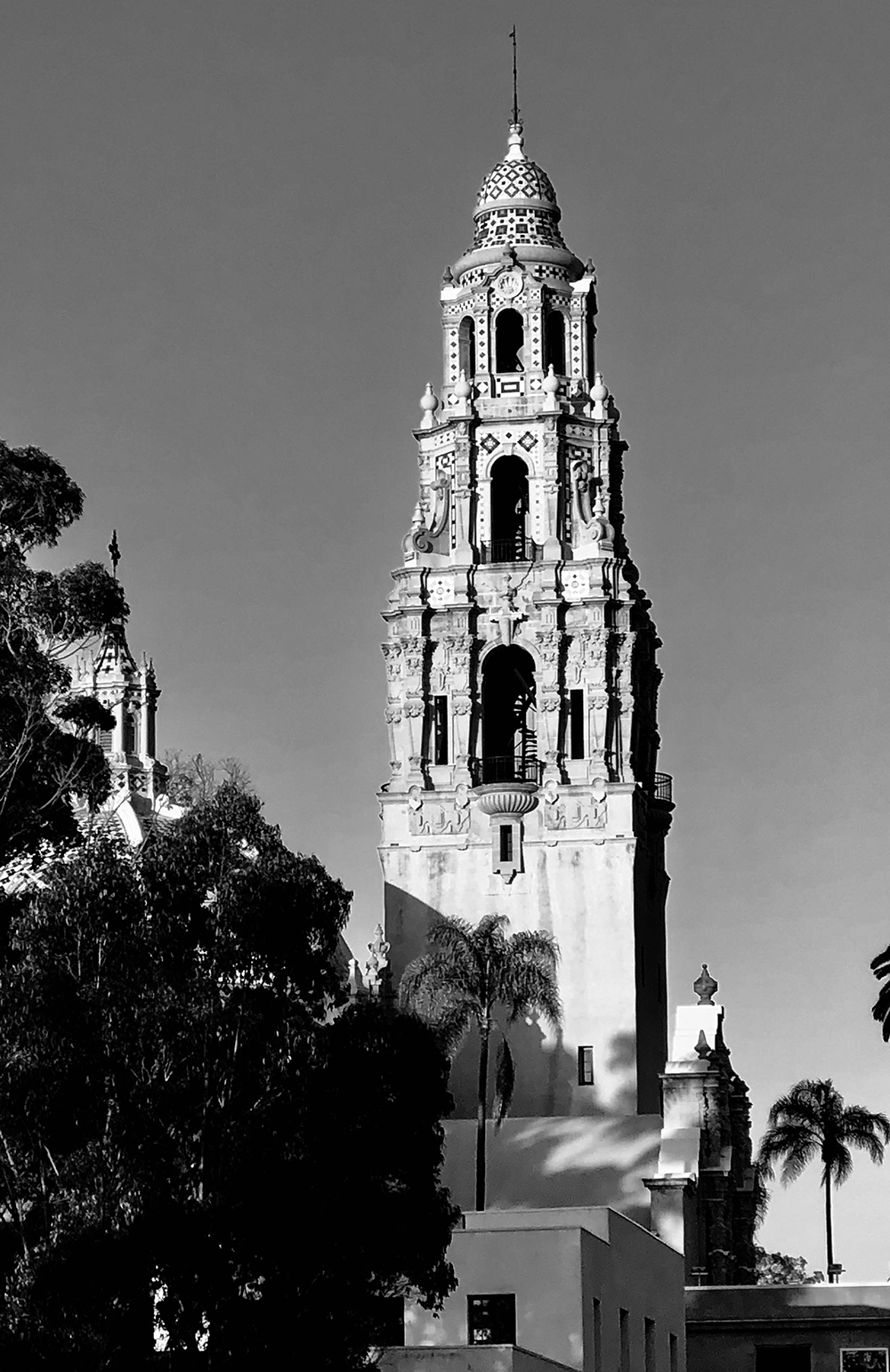

San Diego Housing Market — Quick Snapshot (November 2025)

Bottom line:

San Diego is no longer a frenzy market, but it’s also far from a crash. It’s a selective, pricing-sensitive market where well-positioned homes still sell, and overpriced homes stall.

Sales Activity

- Closed sales are down year-over-year (≈-9% overall), signaling fewer buyers pulling the trigger.

- Pending sales also declined, confirming buyer hesitation heading into winter.

Time on Market Is Up

- Homes are taking significantly longer to sell:

- Detached homes: ~43 days (+19%)

- Attached homes: ~49 days (+32%)

- Buyers are cautious and negotiating more aggressively.

Prices Are Holding (Barely)

- Detached homes: Median price rose to ~$1.05M (+3%)

- Condos/townhomes: Median price slipped slightly to ~$660K (-1.5%)

- Translation: Single-family homes are more resilient, while attached housing feels more pressure.

Inventory & Supply

- Inventory remains tight by historical standards, especially for detached homes.

- Months of supply:

- Detached: ~2.2 months (still seller-leaning)

- Attached: ~3.0 months (more balanced)

- This limited supply is what’s preventing major price declines.

Negotiation Is Back

- Sellers are receiving about:

- 97.1% of list price (detached)

- 96.5% of list price (attached)

- Over-asking wars are rare outside of exceptional properties.

Affordability (Still the Elephant in the Room)

- Affordability remains historically low, despite modest improvement.

- Mortgage rates + high prices = fewer qualified buyers, especially at entry and mid-levels.

What This Means for Sellers

- Pricing and strategy matter more than ever

- Homes that are:

- Properly priced

- Well-prepared

- Marketed aggressively

are still selling — often within the first 2–3 weeks. - “Test the market” pricing is getting punished.

What This Means for Buyers

- You finally have leverage, time, and options

- Concessions, credits, and price reductions are back — especially on stale listings.

The Big Picture

San Diego has shifted into a skill-based market.

Success now depends less on luck and more on strategy, presentation, and execution.

Broward County Housing Market — Quick Snapshot (Oct 2025)

Bottom line:

Broward is firmly a buyer-leaning market, especially for condos. Single-family homes are holding up better, but sellers no longer control the conversation.

Sales Activity

- Closed sales are essentially flat overall (+1%).

- Pending sales jumped sharply:

- Single-family: +24%

- Condos: +11%

- This suggests buyers are re-engaging — but cautiously.

Time on Market Is Way Up

- Median time to contract:

- Single-family: 53 days (+39%)

- Condos: 74 days (+35%)

- Buyers are taking their time and negotiating harder.

Prices Are Splitting by Property Type

- Single-family homes:

- Median price up slightly to ~$615K (+1.6%)

- Condos/Townhomes:

- Median price down sharply to ~$260K (-6.2%)

- Condos are clearly under pressure from supply, insurance, and HOA costs.

Inventory & Supply

- Inventory is rising across the board:

- Single-family supply: ~5.4 months

- Condo supply: ~11+ months

- That condo number is a strong buyer’s market by any definition.

Negotiation Is the Norm

- Sellers are receiving:

- ~92.8% of list price (single-family)

- ~89.6% of list price (condos)

- Price reductions and concessions are common, especially for condos.

Affordability

- Affordability improved slightly, but mostly due to price softening, not wage growth.

- Condos appear “more affordable” on paper, but rising fees offset much of that benefit.

Broward Takeaway

This is a selective market.

- Well-priced homes sell.

- Overpriced listings sit.

Condos require aggressive pricing and patience.

South Palm Beach County — Quick Snapshot (Oct 2025)

Bottom line:

South Palm Beach is healthier than Broward, especially for single-family homes, but it’s no longer a seller’s free-for-all.

Sales Activity

- Closed sales up meaningfully overall (+5.7%).

- Pending sales surged:

- Single-family: +27%

- Condos: +21%

- Demand here is clearly stronger than in Broward.

Time on Market

- Homes are taking longer to sell, but less dramatically:

- Single-family: ~39 days

- Condos: ~66 days

- Buyers still hesitate, but good listings move.

Prices: Stable with Some Soft Spots

- Single-family homes:

- Median price dipped slightly to ~$635K (-1.6%)

- Condos/Townhomes:

- Median price flat to slightly up (~$281K)

- Price stability is much better here than in Broward.

Inventory & Supply

- Single-family inventory fell (-12%)

- Months supply dropped to ~4.3 months

- Condo inventory slightly down, but still elevated

- ~8 months of supply

- This is the key difference vs. Broward.

Seller Leverage (Limited, but Real)

- Sellers are receiving:

- ~91.9% of list price (single-family)

- ~87.8% of list price (condos)

- Negotiation is common, but not brutal for good homes.

Affordability

- Affordability improved modestly, especially for single-family homes.

- South Palm Beach is benefiting from relative scarcity.

South Palm Beach Takeaway

This is a balanced-to-slight seller’s market for houses and a buyer’s market for condos.

Big Picture: Florida vs. San Diego

- San Diego: Low inventory keeps prices propped up

- Broward: Inventory is doing the damage, especially condos

- South Palm Beach: Supply is tighter → prices more resilient

Wild Ride in Chula Vista: From 100 Days Stalled to Sold $125,000 Over Asking

The Soho Lane Case Study This Month Is a Must-Read

It’s a perfect example of how the right preparation and strategy can still produce an exceptional outcome—even when the market suggests otherwise.

Let’s Connect – Your Questions Answered & Consultation

We love hearing from you. Have a question about the market or the buying/selling process? Reply with your questions, and you might see it answered in next month’s newsletter. If you’re feeling ready to make a move, let’s chat.

Schedule a free consultation at your convenience—we’re here to offer personalized advice and white-glove service for all your real estate needs.

Book Your One-on-One Meeting Below or give us a call at 858.692.8586

CA DRE: #01332115